[ICO Review] Ceyron Token (CEY)

- Ringkesan proyek

Konsep

Dadi, ing idea iki yaiku duwe layanan kaya Coinbase lan Mastercard sing digabungake bebarengan karo konsep Bukti saham.

Pemegang token CEY bakal duwe:

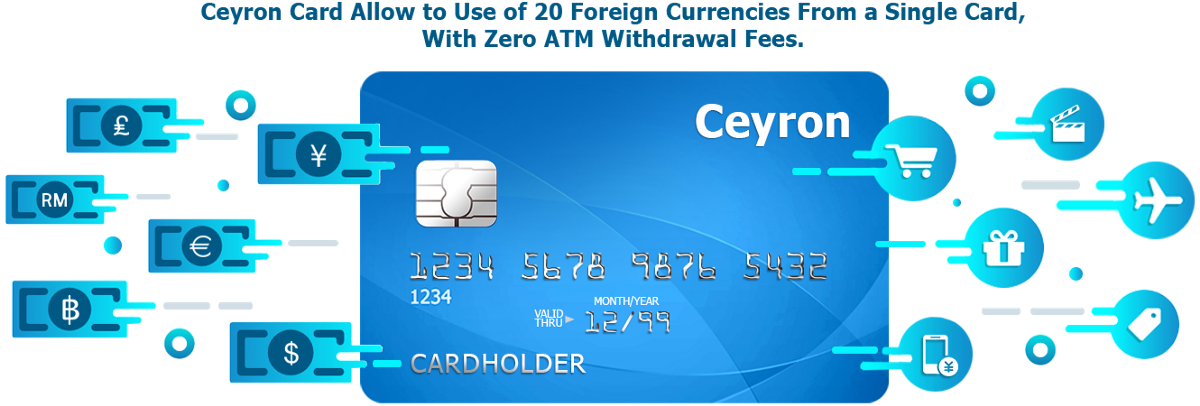

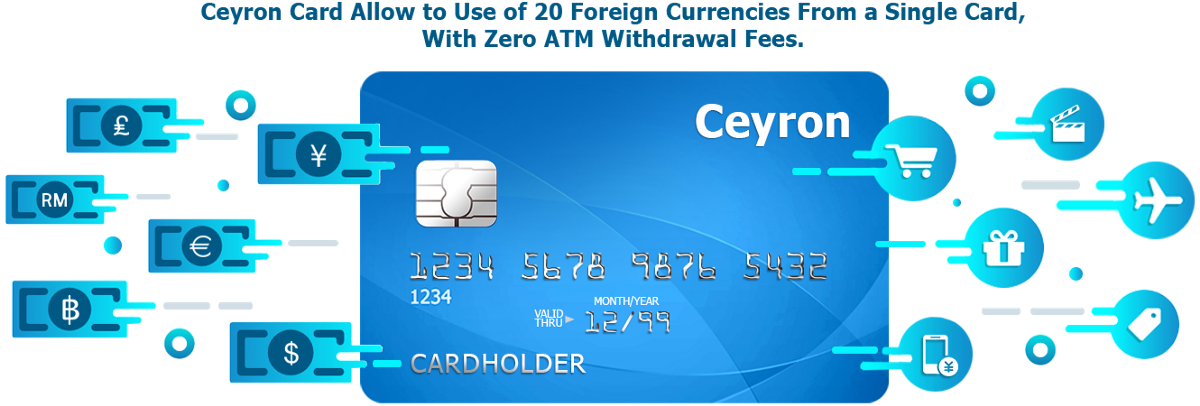

Easy access to spend 20 fiat currencies + supported cryptocurrencies via The CEY Card (a physical, virtual, and debit MasterCard with a mobile application for convenience) with competitive fees compared to the current international debit card.

Annual dividends (might have, not guarantee): from a portion of potential periodic income earned by the Fund — from their financial investments, to be exact.

Last but not least: a high in value token — CEY token — with a stable and high-ROI-potential portfolio of credit assets

kanthi integritas, safety, keamanan, anonim-aman lan transparan ing sistem desentralisasi sing dhuwur-dhuwur amarga kabeh teknologi sing diganti ing donya: intelijen buatan, learning machine lan, mesthi, blockchain.

Apa token Ceyron (CEY)?

Ceyron Tokens minangka token digital kontrak pinter Ethereum sing makili kepemilikan bermanfaat ing saham non-voting ing perusahaan sing ngetokake - Ceyron Finance Ltd. (CFL)

Apa token Ceyron (CEY)?

Ceyron Tokens minangka token digital kontrak pinter Ethereum sing makili kepemilikan bermanfaat ing saham non-voting ing perusahaan sing ngetokake - Ceyron Finance Ltd. (CFL)

CEY Tokens are non-refundable and they are not for speculative investment.

Sawetara dhéfinisi kanggo mangertèni:

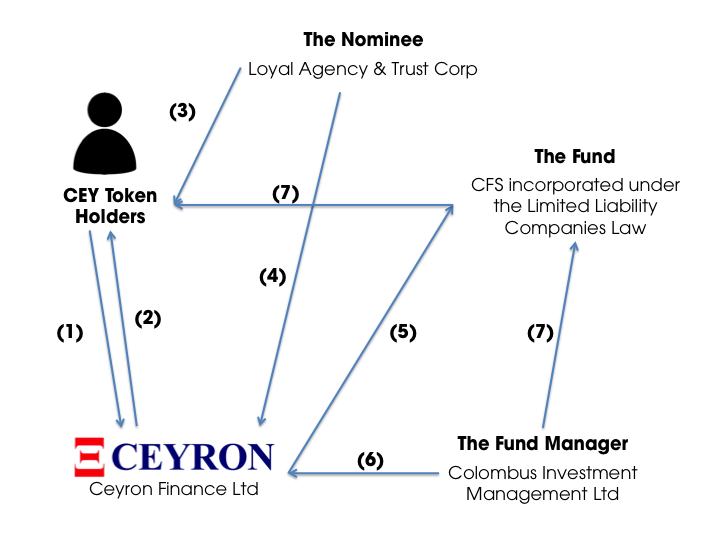

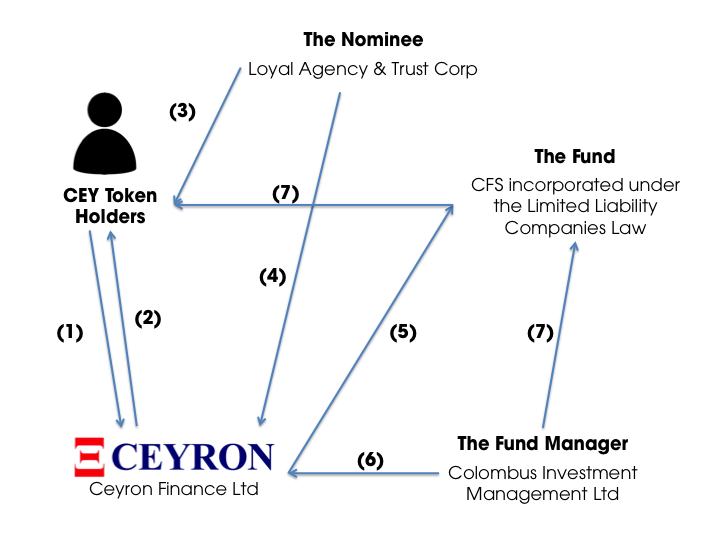

Sambungan ing antarané defisit kasebut

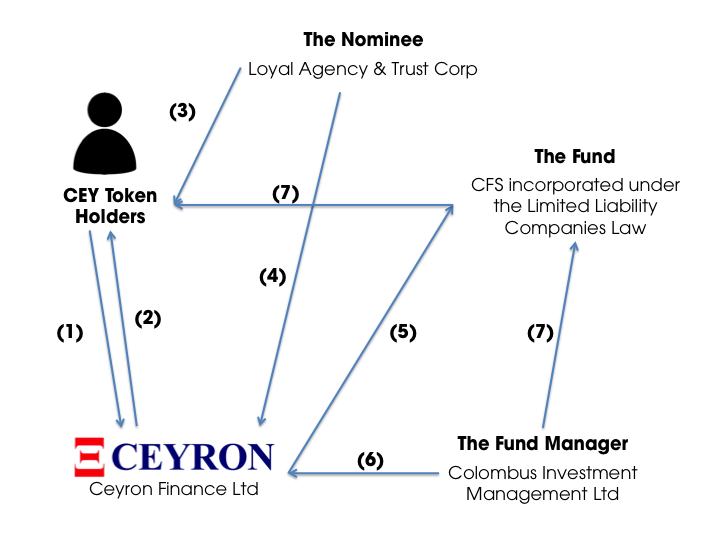

The investor or CEY Token holders pay their money to buy the tokens from CFL (1)

CFL issue CEY tokens to their investors and provide services as well as distribute annually the dividends (2)

The “Nominee”: Legal title of the tokens will be held by Loyal Agency & Trust Corp (“LATC” or the “Nominee”) for the token holders (3) for transparency and being trust-worthy since it is independent of and not involved in the management or operation of “the Fund” or “Fund Manager” (4)

The “Fund”: Ceyron Finance Sarl (CFS), is a Limited Liability Company incorporated under the Limited Liability Companies Law, (the “Fund”), and is wholly owned by Ceyron Finance Ltd (5). Participation in the Fund will primarily be conducted through the CEY Token. The Fund will be managed and advised by Colombus Investment Management Ltd

The “Fund Manager”: Colombus Investment Management Ltd, is a British Virgin Islands registered as an independent alternative investment management company (6) specializing in alternative assets and global asset allocation. The Fund Manager will be responsible for the Fund’s operations and will perform all services and activities relating to the management of the Fund’s assets, liabilities, and operations. (7)

Tujuan lan Strategi Investasi Dana

Investment objective: is to provide the highest ROI (return-on-investment) through a proprietary quantitative approach to underwriting credit assets, to be provided by Colombus Investment Management Ltd.

Investment strategy: driven by data science where they apply machine learning within fully non-parametric statistical models to gain expected returns on financial investments.

Pangentukan net sing ditampa dening Dana sajrone sasi tartamtu bakal umum ditahan kanggo reinvestment. Sebagean potensial pangasilan periodik bisa digunakake kanggo nyebarake deviden saben taun disetujui dening dewan CFL lan shareholders voting kanggo pemegang CEY Token sing kasebut ing ndhuwur.

Pasar lan masalah

Ana akeh masalah sing arep dilakoni, kene sawetara sing aku sumurup:

Cryptocurrency world's problem: Cryptocurrencies are growing at a rapid rate. Booming exponentially, you might call.

Total Market Cap saka 1/1/2017 nganti saiki

Sing bisa dadi pratandha apik lan ala kanggo investor. Burung awal bisa entuk akeh bathi amarga prabedan, sing dadi tandha apik. Saliyane, berkembang kanthi cepet kaya sing nggawe anyar, lan malah sawetara pengalaman, investor kuwatir banget amarga paling cryptocurrencies ora didukung dening aset apa - sing tenan beboyo lan bab kanggo wong-wong mau.

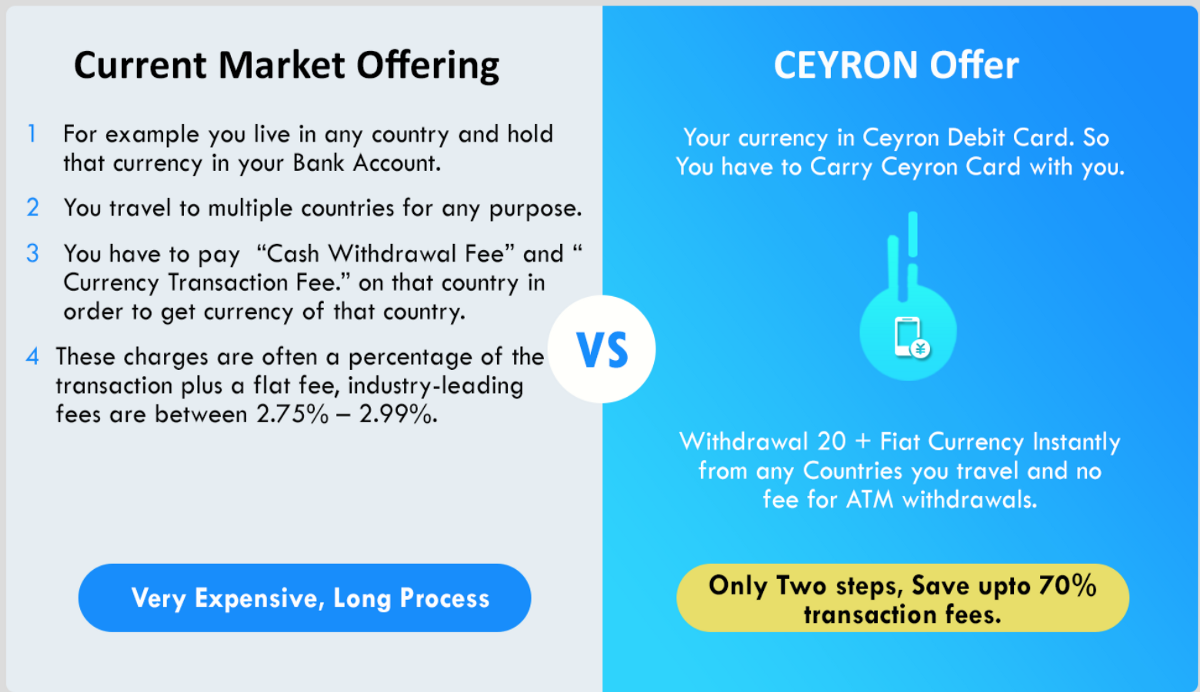

- Masalah layanan perbankan tradisional

Mbalik maneh menyang layanan perbankan tradisional kaya MasterCard. Iki minangka pasar ageng kanthi akeh potensi kanggo ngasilake gelombang hype iki. Ayo sampeyan ngomong sampeyan lelungan menyang negara liya ing ngendi dhuwit nasional sing digunakake. Sampeyan nggawa kertu debit internasional "trep" sampeyan. Sing bakal gampang kaya normal?

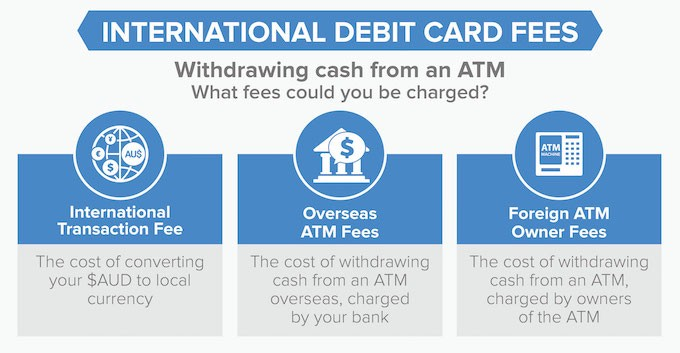

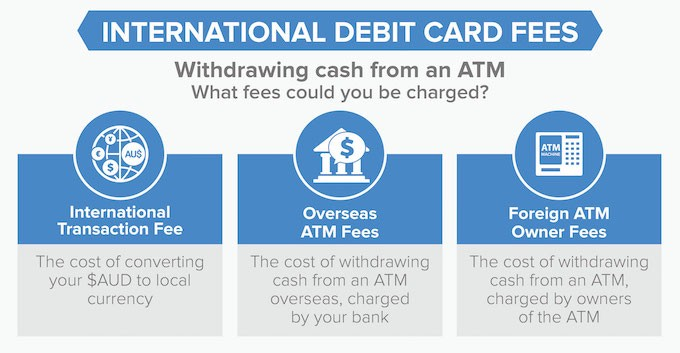

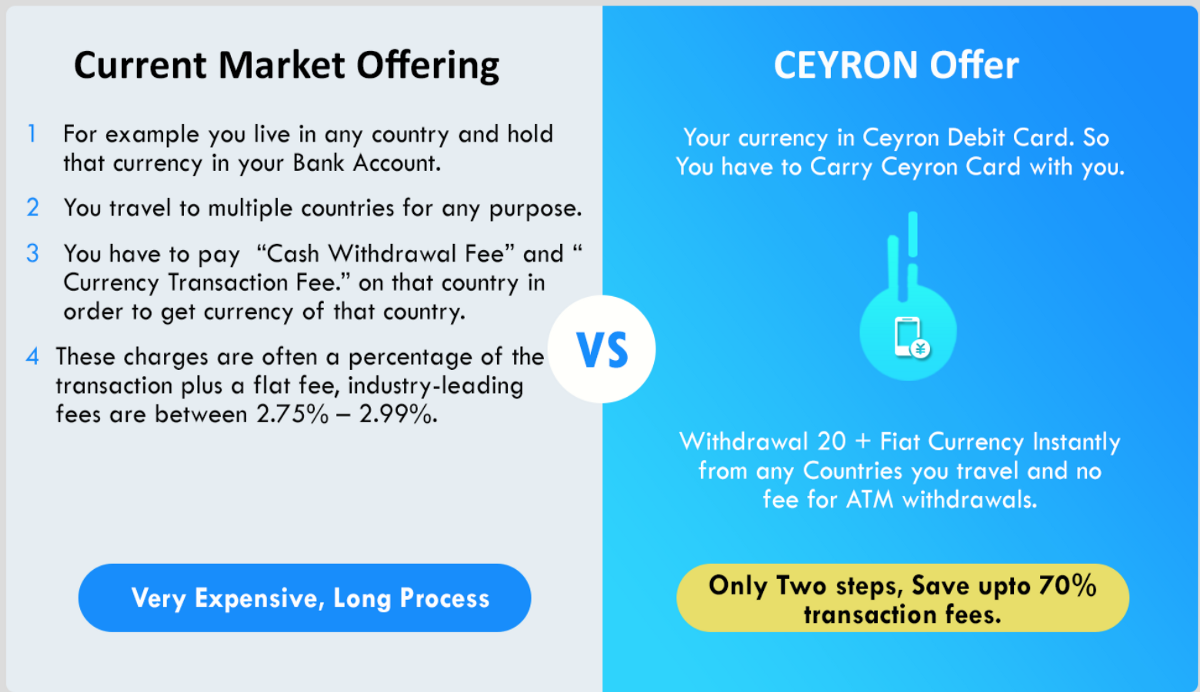

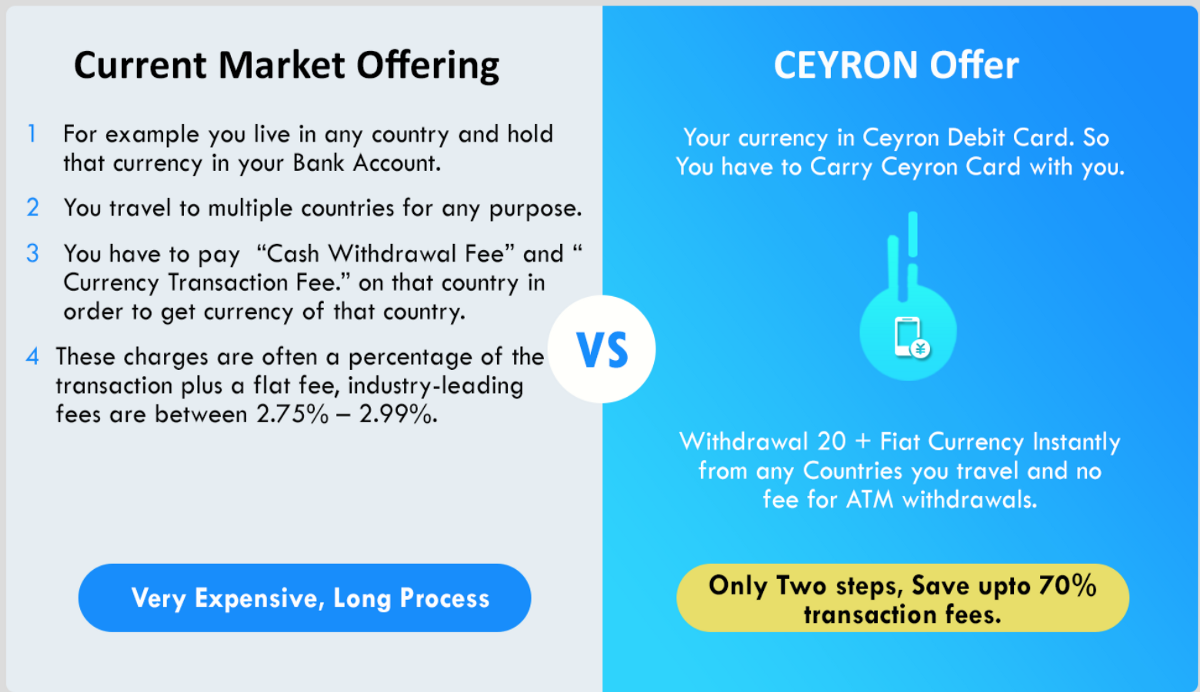

Nanging, sampeyan bakal mbayar layanan kasebut 2 jinis bayaran: "Biaya Pengeluaran Tunai" lan "Biaya Transaksi Mata Uang" lan kadhangkala, malah ana biaya sing disebut "Biaya ATM Fisik Asing". Biaya kasebut asring persentasi saka transaksi ditambah biaya flat, biaya indhustri sing ndhelik ing antarane 2.75% - 2.99%

lan sing ora bakal dadi jumlah sing cilik kaya sampeyan mbayangake yen sampeyan gabungke kabeh kali sampeyan menyang luar negeri nganggo kertu kasebut.

- Masalah ing wilayah antarane 2 donya

Nggunakake layanan kaya-Coinbase, sampeyan bisa njaluk cryptocurrencies sing dikarepake saka fiat. Nanging pasar iki mung wis operasi sawetara taun. Ilustrasi tingkat saiki saka kadewasan ing industri yaiku beda relatif ing antarane dhuwit ing mata uang fiat Bitcoin ing macem-macem pertukaran utama.

Amarga ironi, rega paling apik saka vendor kanthi likuiditas sing paling murah ing ngendi dhuwit kasebut ora bisa diwujudake kanthi cepet utawa kanthi rega kasebut. Malah panyedhiya paling gedhé lan paling mantep mbayar biaya sethithik 7% kanggo transaksi fiat

Masalah liyane: Volatility and Cash Cash. Crypto investasi utawa non-crypto gedhe-gedhe, ana ton saka sub-investasi lan yen sampeyan yakin karo skills nandur modal, sampeyan bakal bakal kepunjulen lan aset bisa nyelehake ing Nilai drastis utawa duwe aliran awis miskin - nggawe "Mati" investasi, ora kanggo sebutne entuk bali wae. Sampeyan kudu mbutuhake portofolio kuwat karo budget sing seimbang kanggo ngamanake investasi sampeyan.

TLDR: jenis layanan sing isih enom, ora fleksibel lan dhuwur ing biaya ing pasar kuwatir ing ngendi nilai-nilai aset sampeyan bisa nyedhaki dramatically sawise 1 wengi.

Ing tampilan sing luwih akeh, ing visi macroeconomic lan utamané ing pasar Afrika, tim Ceyron nemtokake masalah kasebut:

Low Bank Rate :The economy of third-world countries like ones in Africa is highly liquidated and has a very bad financial footprint: Less than 10% of adults have bank accounts and more than 85% of trade is cash.

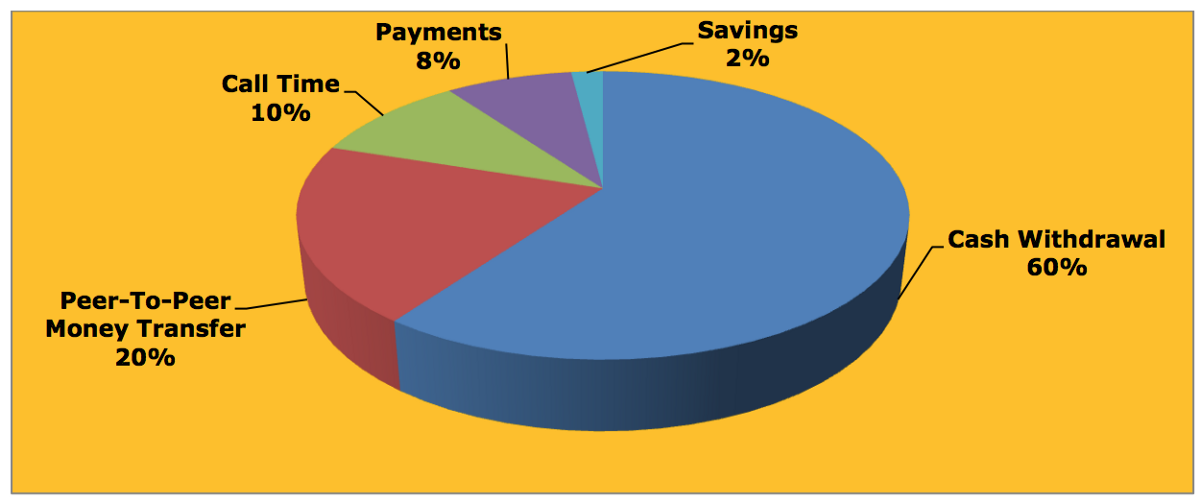

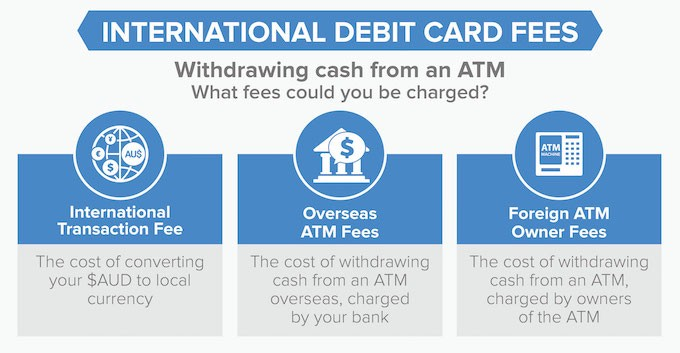

Very Low Usage Rates: In the world, 12% of account holders are in Africa. However, the level of inclusion in the financial system is very low. The behavioral analysis of the average paying user is similar to the general trend: the payment is equal to at least 60% of the transaction volume; Peer-to-peer transactions 20%; 10% call duration, 8% payment and 2% savings.

Pasar sing paling kompetitif: Lingkungan dhuwit seluler ing Afrika tansaya kompetitif. Kompetisi sing tambah iki tegese konsumen duwe opsi sing luwih akeh. Solusi Ceyron

Nggunakake kertu debit rendah: Kartu debit prabayar mung digunakake kanggo tumbas lan layanan titik- jaran (jarang). Para pemegang TOE, Nanging, duwe hak istimewa nampa dividen tahunan ing kertu CFL, sing bakal dadi motivasi gedhe kanggo wong nggunakake kertu kasebut.

Kurang kredit sing aman lan ora kenceng uga minangka pendapatan tetep lan stabil kanggo pelamar kredit: Ing Afrika, paling ora bisa ngundhakake kredit. CFL kepengin ngatasi masalah iki. Secara khusus, Tokoh CEY bisa dianggep minangka sumber pendapatan sing disebarake marang para pengusaha amarga layak kanggo kredit. Kejabi, aplikasi silihan nduweni defisit income sing stabil lan tetep.

Solusi CEYRON

Ora kanggo sebutno "standar" sing menehi proyek blockchain menehi integritas, keamanan, keamanan, anonim-aman lan transparan ing sistem desentralisasi berprestasi tinggi, CEYRON nawakake solusi apik kanggo masalah sing diidentifikasi ing ndhuwur:

CFL Credit Portfolio

Kanggo ngurangi volatility saka Token CEY, CFL ndhukung nilai kasebut liwat portofolio aset kredit aman. Sabanjure, panuku saka aset kredit portofolio banjur disimpen kanggo reinvestment maneh menyang portofolio aset kredit kanggo nyoba nambah dhasar dhasar sing dhuwure saben Token CEY.

Portofolio aset kredit, sing digawe kanthi nggunakake intelijen buatan lan mesin, bakal luwih aman saka bungkus jaminan kanggo nambah stabilitas lan pengembalian.

Kanggo mesthekake, Dana nduweni portofolio investasi alternatif apik banget karo jangkoan global kanthi tujuan ngasilake pulangan siji digit sing stabil kanthi volatilitas sing cendhak lan long-term banget. Diversifikasi ditindakake kanthi nggabungake dana alternatif sing dipilih karo strategi lan lokasi sing beda banget, dikelola dening manajer aset sing didegaké lan anjog ing gaya investasi utawa pasar tartamtu.

CEY Card Kartu

CEY: MasterCard fisik, virtual, lan debit kanthi aplikasi seluler sing bakal ngidini kanggo nggunakake 20 mata uang asing lan cryptocurrencies sing utama saka kertu tunggal.

Nggunakake kertu iki, sampeyan bisa nglampahi, ngganti lan ngirim lan nampa dhuwit kanthi internasional kanthi anonimitas sing padha karo Bitcoin tanpa keterlibatan pihak katelu ing cara sing paling aman lan paling cepet.

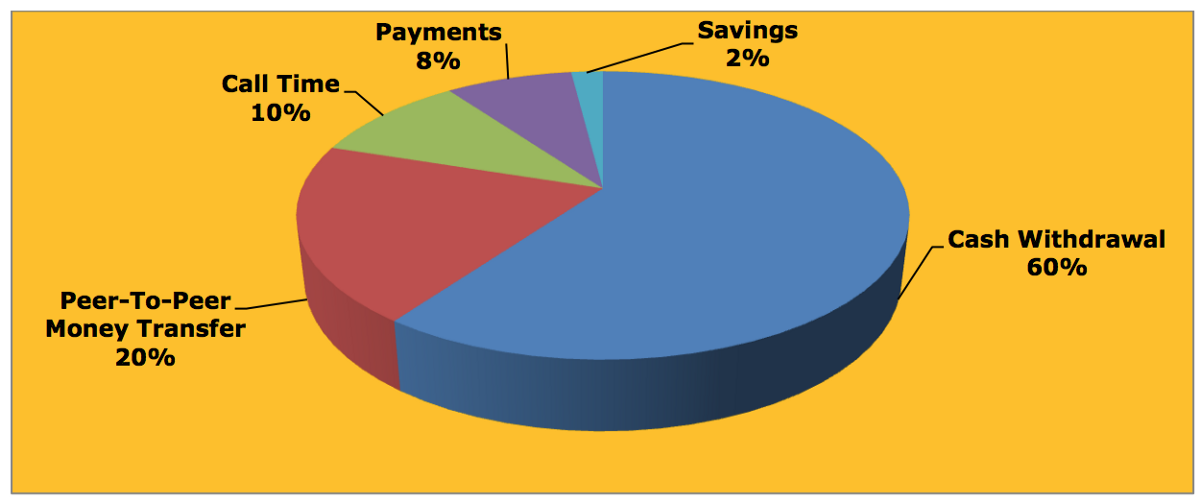

CFL bisa nylametake pelanggan nganti 70% ing biaya kasebut:

Currency Transaction Fee: Currencies can be exchanged both at the point of sale through an app with 3% fee for CFL compared to 3.75% of industry average.

Cash Withdrawal Fee: CFL charges no fee for ATM withdrawals at all (the traditional standard fee for ATM withdrawals is 1.5%).

Money Transfer Fee: The CFL mobile application will contain additional functionality to transfer funds in any currency between merchants, as well as friends and family accounts, for free.

Bareng karo Kartu CEY, Situs Pengirim Ceyron Swasta memungkinkan Anda membeli dan menjual CEY dan cryptocurrencies lainnya.

Kejabi, Kertu CFL ngandhakake bakal duwe Partner kanggo ngetrapake biaya. Iki bakal ngijini integrasi saka aplikasi seluler kanggo nggampangake ngatur travel itineraries lan pranala menyang akeh travel partners kanggo e-panrimo Manajemen.

Tokoh Keamanan CFL

1. CFL intends to provide but does not guarantee, the token holders with an annual dividend, which must be approved by the Board of Directors and holders of voting shares.

2. CFL intends to invest eighty-five percent (85%) of the proceeds received by CFL from this Offering in the Fund, and the Fund, in turn, will invest in credit assets, thereby seeking to create a stable, growing cash flow yielding base for the CEY Token (Cash flow yields cannot be guaranteed, and may be impacted by both market and regulatory conditions).

3. CFL intends to use modest leverage to further enhance the returns from its credit portfolio to facilitate ongoing and continued reinvestment to grow the credit portfolio underpinning 15 the CEY Tokens (Enhanced returns cannot be guaranteed, and may be impacted by both market and regulatory conditions).

4. CFL will enhance its ability to establish its credit portfolio with leverage by providing its warehouse lender a credit surety bond.

5. CFL intends to maintain a cash, securities, and token reserve at all times to ensure liquidity for CEY Token holders (Liquidity of assets cannot be guaranteed, and may be impacted by both market and regulatory conditions).

6. CFL will enter into alliances with surety wrap providers that will be used to mitigate the risk of total capital loss. However, use of these financial instruments does not constitute a guarantee against any and all eventualities.

Aliansi Strategis Aliansi strategis

CFL minangka pimpinan lan pamimpin berpengalaman ing bidhang teknologi, keuangan, lan perbankan.

Coinfirm.io: CFL intends to enter into a service agreement with Coinfirm.io — a market leader in KYC/AML (Anti Money Laundering) checks for each token holder application.

Ambisafe is a blockchain technology pioneer and ICO offering company helping the world become more decentralized since 2010. Their work has been critical of projects such as Tether and Bitfinex. More recently Ambisafe is behind such ICO successes as Polybius, TaaS, and Chronobank. CFL and Ambisafe plan to jointly develop a wallet management tool, which CFL will use to facilitate token holders’ ability to manage their digital wallets.

Loyal Bank is a bank registered under the laws of Saint Vincent & The Grenadines and is the debit card provider having one of the most competitive fees across several fiat currencies in the industry. -> this partnership might allow CFL to maintain a low rate of 1% for transactions charge.

TLDR: Ceyron nggawe sawetara garis bisnis lan bakal nglaporake financial kanggo investor.

Firstly, they will have the Ceyron Funds, a secured portfolio built by a seasoned financial management team.

Secondly, Ceyron will also offer you the opportunity to spend, exchange and transfer cryptocurrencies and fiat currencies with their Ceyron Debit MasterCard and exchange site.

Finally, with so much market uncertainties, Ceyron is here to offer you one of the only private security tokens representing an equity portion of Ceyron with the intent to offer security, transparency and dividends — The CEY Token

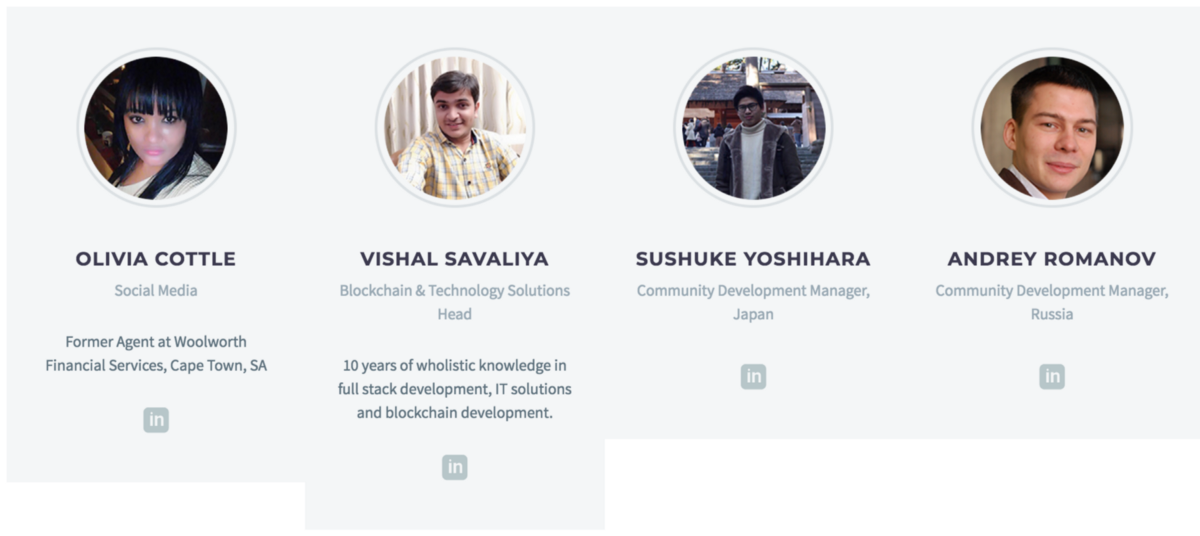

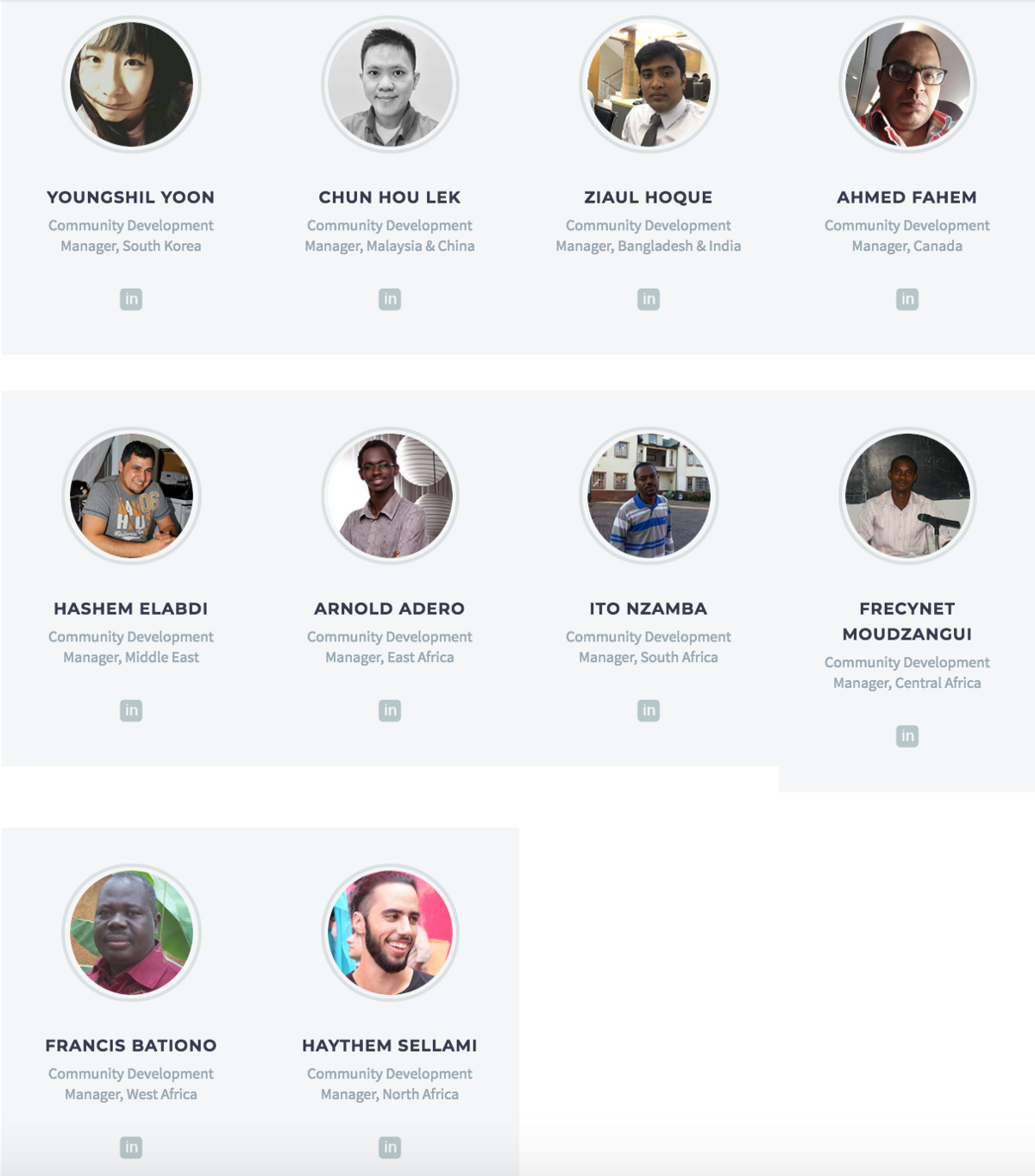

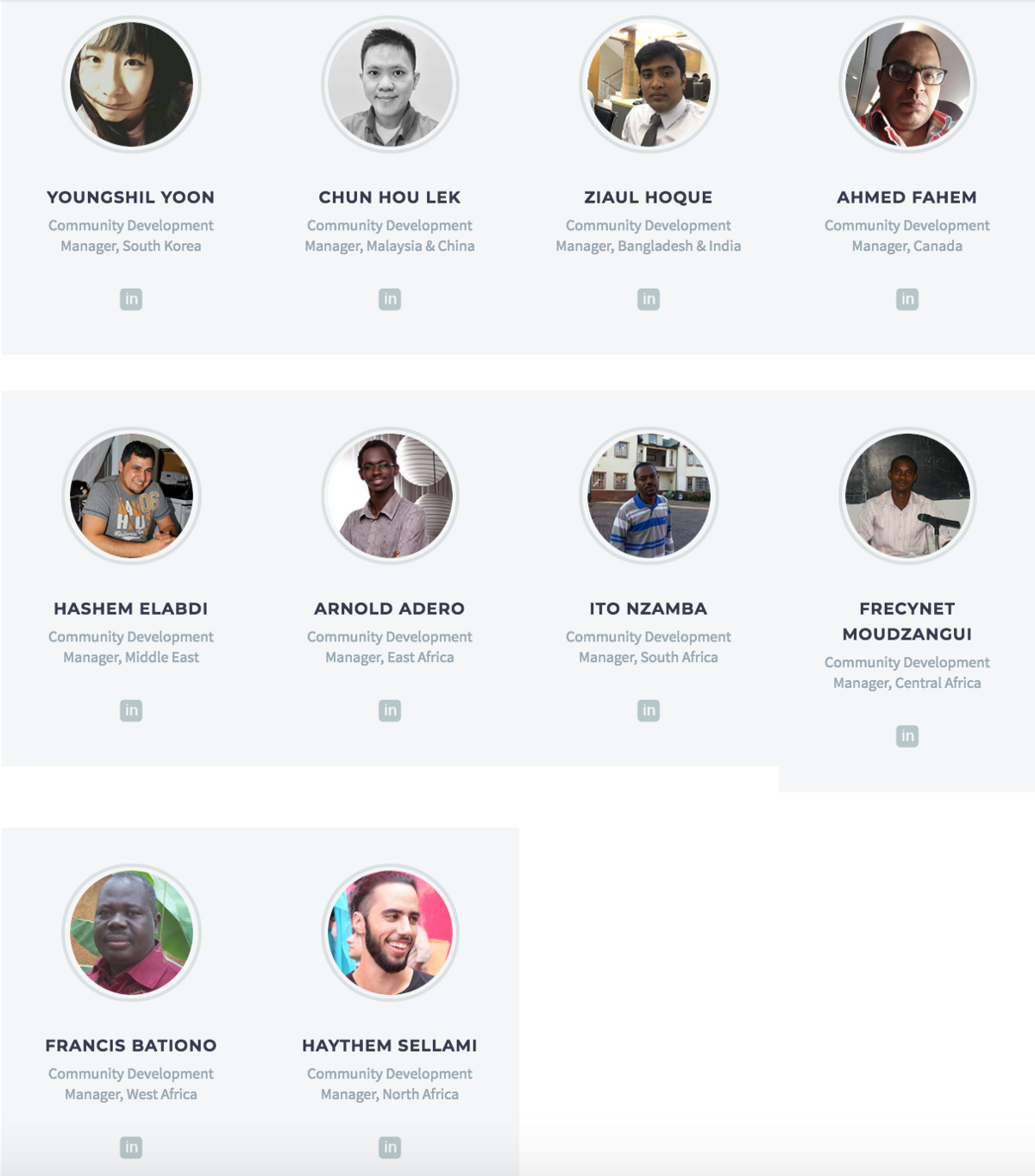

- Tim

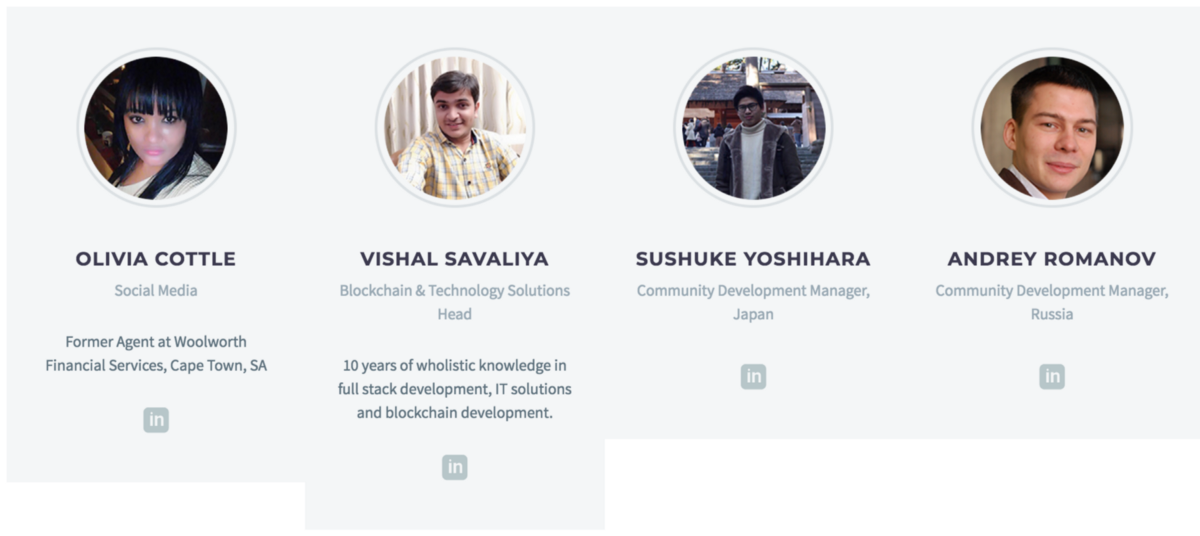

Ceyron Finance Ltd digawé dening tim saka mantan Bankers saka Bank USA sing biso dipercoyo.

Papan eksekutif

EB kasusun saka talenta sing dialami ing bidang perbankan, bisnis lan investasi finansial, sing minangka titik kuat kanggo tim ing implementasine gagasan proyek.

Siji bab sing nggawe aku kuwatir yaiku tim Dev. Wiwit biasane nalika ICO, para manajer proyek bakal nampilake para pengembang genius (bareng karo bakat ing lapangan layanan, kaya sing dituduhake ing ndhuwur). Nanging iki ICO aku mung bisa ndeleng Blockchain & Technology Solutions Head. Siji geguritan yaiku wong iki (wong Kepala IT) nduweni 10 taun pengalaman ing pembangunan tumpukan lengkap, solusi IT lan pengembangan blockchain.

Padha duwe akeh sumber daya kanggo aktivitas pemasaran, sing apik tumindake ing tahap iki cryptocurrency world amarga wong sing efek banget sensitif lan crowding bisa nyebabake akeh pump apik.

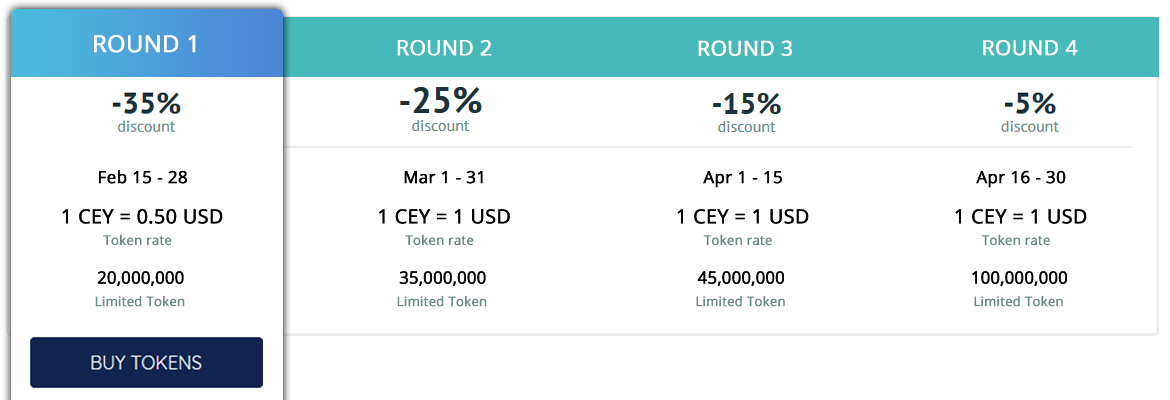

- Informasi akeh

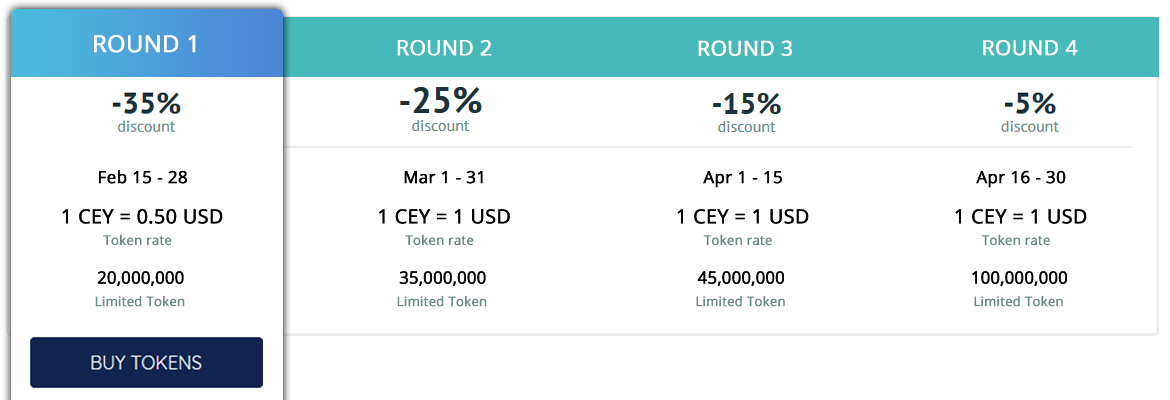

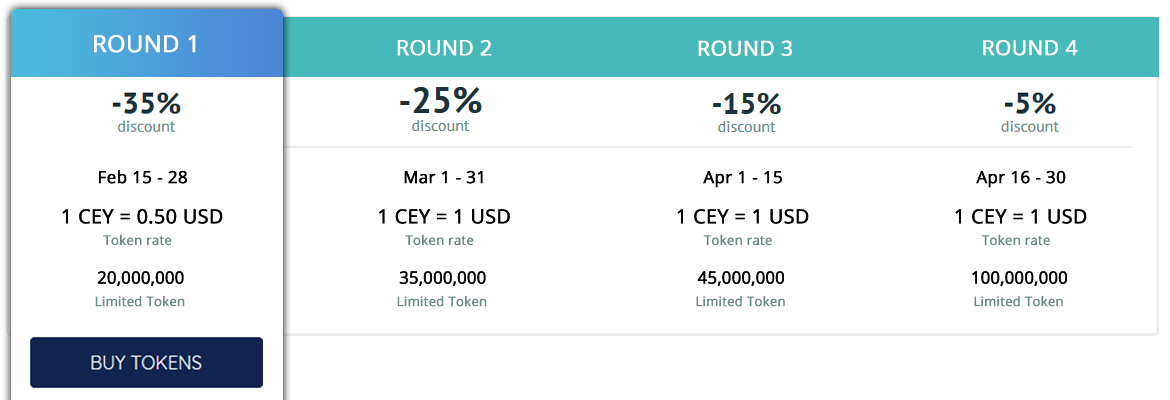

Jeneng Token: Ceyron

Simbol Token: CEY

Contract Alamat: 0xebc71036a37451e87cc43af8ae7ac123aa750dcb

Desimal: 8

Price Token: $ 1.00 USD

Duit sing ditampa: BTC, ETH, LTC lan USD

Jumlah Token Dijual: 250.000.000

Pra-Sale: 2/16 / 18-3 / 15/18

Pra-Sale Diskon: 30%, 25%, 15%

Miwiti Token Sale: 3/16/18

Akhir Token Sale: Nalika Hard tutup wis tekan

Cap Soft: TBA

Hard Cap: TBA

Links

Situs web: https://ceyron.io/

Whitepaper: https://ceyron.io/wp-content/uploads/2018/02/White-Paper-ICO-CEY-Token-UPDATED31012018.pdf

Saluran Telegram: https://t.me/joinchat/HlFUXhLIUYQL88_NtoM4sA

- Ringkesan proyek

Konsep

Dadi, ing idea iki yaiku duwe layanan kaya Coinbase lan Mastercard sing digabungake bebarengan karo konsep Bukti saham.

Pemegang token CEY bakal duwe:

Easy access to spend 20 fiat currencies + supported cryptocurrencies via The CEY Card (a physical, virtual, and debit MasterCard with a mobile application for convenience) with competitive fees compared to the current international debit card.

Annual dividends (might have, not guarantee): from a portion of potential periodic income earned by the Fund — from their financial investments, to be exact.

Last but not least: a high in value token — CEY token — with a stable and high-ROI-potential portfolio of credit assets

kanthi integritas, safety, keamanan, anonim-aman lan transparan ing sistem desentralisasi sing dhuwur-dhuwur amarga kabeh teknologi sing diganti ing donya: intelijen buatan, learning machine lan, mesthi, blockchain.

Apa token Ceyron (CEY)?

Ceyron Tokens minangka token digital kontrak pinter Ethereum sing makili kepemilikan bermanfaat ing saham non-voting ing perusahaan sing ngetokake - Ceyron Finance Ltd. (CFL)

CEY Tokens are non-refundable and they are not for speculative investment.

Sawetara dhéfinisi kanggo mangertèni:

Sambungan ing antarané defisit kasebut

Sambungan ing antarané defisit kasebut

The investor or CEY Token holders pay their money to buy the tokens from CFL (1)

CFL issue CEY tokens to their investors and provide services as well as distribute annually the dividends (2)

The “Nominee”: Legal title of the tokens will be held by Loyal Agency & Trust Corp (“LATC” or the “Nominee”) for the token holders (3) for transparency and being trust-worthy since it is independent of and not involved in the management or operation of “the Fund” or “Fund Manager” (4)

The “Fund”: Ceyron Finance Sarl (CFS), is a Limited Liability Company incorporated under the Limited Liability Companies Law, (the “Fund”), and is wholly owned by Ceyron Finance Ltd (5). Participation in the Fund will primarily be conducted through the CEY Token. The Fund will be managed and advised by Colombus Investment Management Ltd

The “Fund Manager”: Colombus Investment Management Ltd, is a British Virgin Islands registered as an independent alternative investment management company (6) specializing in alternative assets and global asset allocation. The Fund Manager will be responsible for the Fund’s operations and will perform all services and activities relating to the management of the Fund’s assets, liabilities, and operations. (7)

Tujuan lan Strategi Investasi Dana

Investment objective: is to provide the highest ROI (return-on-investment) through a proprietary quantitative approach to underwriting credit assets, to be provided by Colombus Investment Management Ltd.

Investment strategy: driven by data science where they apply machine learning within fully non-parametric statistical models to gain expected returns on financial investments.

Pangentukan net sing ditampa dening Dana sajrone sasi tartamtu bakal umum ditahan kanggo reinvestment. Sebagean potensial pangasilan periodik bisa digunakake kanggo nyebarake deviden saben taun disetujui dening dewan CFL lan shareholders voting kanggo pemegang CEY Token sing kasebut ing ndhuwur.

Pasar lan masalah

Ana akeh masalah sing arep dilakoni, kene sawetara sing aku sumurup:

Cryptocurrency world's problem: Cryptocurrencies are growing at a rapid rate. Booming exponentially, you might call.

Total Market Cap saka 1/1/2017 nganti saiki

Sing bisa dadi pratandha apik lan ala kanggo investor. Burung awal bisa entuk akeh bathi amarga prabedan, sing dadi tandha apik. Saliyane, berkembang kanthi cepet kaya sing nggawe anyar, lan malah sawetara pengalaman, investor kuwatir banget amarga paling cryptocurrencies ora didukung dening aset apa - sing tenan beboyo lan bab kanggo wong-wong mau.

- Masalah layanan perbankan tradisional

Mbalik maneh menyang layanan perbankan tradisional kaya MasterCard. Iki minangka pasar ageng kanthi akeh potensi kanggo ngasilake gelombang hype iki. Ayo sampeyan ngomong sampeyan lelungan menyang negara liya ing ngendi dhuwit nasional sing digunakake. Sampeyan nggawa kertu debit internasional "trep" sampeyan. Sing bakal gampang kaya normal?

Nanging, sampeyan bakal mbayar layanan kasebut 2 jinis bayaran: "Biaya Pengeluaran Tunai" lan "Biaya Transaksi Mata Uang" lan kadhangkala, malah ana biaya sing disebut "Biaya ATM Fisik Asing". Biaya kasebut asring persentasi saka transaksi ditambah biaya flat, biaya indhustri sing ndhelik ing antarane 2.75% - 2.99%

lan sing ora bakal dadi jumlah sing cilik kaya sampeyan mbayangake yen sampeyan gabungke kabeh kali sampeyan menyang luar negeri nganggo kertu kasebut.

lan sing ora bakal dadi jumlah sing cilik kaya sampeyan mbayangake yen sampeyan gabungke kabeh kali sampeyan menyang luar negeri nganggo kertu kasebut.

- Masalah ing wilayah antarane 2 donya

Nggunakake layanan kaya-Coinbase, sampeyan bisa njaluk cryptocurrencies sing dikarepake saka fiat. Nanging pasar iki mung wis operasi sawetara taun. Ilustrasi tingkat saiki saka kadewasan ing industri yaiku beda relatif ing antarane dhuwit ing mata uang fiat Bitcoin ing macem-macem pertukaran utama.

Amarga ironi, rega paling apik saka vendor kanthi likuiditas sing paling murah ing ngendi dhuwit kasebut ora bisa diwujudake kanthi cepet utawa kanthi rega kasebut. Malah panyedhiya paling gedhé lan paling mantep mbayar biaya sethithik 7% kanggo transaksi fiat

Amarga ironi, rega paling apik saka vendor kanthi likuiditas sing paling murah ing ngendi dhuwit kasebut ora bisa diwujudake kanthi cepet utawa kanthi rega kasebut. Malah panyedhiya paling gedhé lan paling mantep mbayar biaya sethithik 7% kanggo transaksi fiat

Masalah liyane: Volatility and Cash Cash. Crypto investasi utawa non-crypto gedhe-gedhe, ana ton saka sub-investasi lan yen sampeyan yakin karo skills nandur modal, sampeyan bakal bakal kepunjulen lan aset bisa nyelehake ing Nilai drastis utawa duwe aliran awis miskin - nggawe "Mati" investasi, ora kanggo sebutne entuk bali wae. Sampeyan kudu mbutuhake portofolio kuwat karo budget sing seimbang kanggo ngamanake investasi sampeyan.

TLDR: jenis layanan sing isih enom, ora fleksibel lan dhuwur ing biaya ing pasar kuwatir ing ngendi nilai-nilai aset sampeyan bisa nyedhaki dramatically sawise 1 wengi.

Ing tampilan sing luwih akeh, ing visi macroeconomic lan utamané ing pasar Afrika, tim Ceyron nemtokake masalah kasebut:

Low Bank Rate :The economy of third-world countries like ones in Africa is highly liquidated and has a very bad financial footprint: Less than 10% of adults have bank accounts and more than 85% of trade is cash.

Very Low Usage Rates: In the world, 12% of account holders are in Africa. However, the level of inclusion in the financial system is very low. The behavioral analysis of the average paying user is similar to the general trend: the payment is equal to at least 60% of the transaction volume; Peer-to-peer transactions 20%; 10% call duration, 8% payment and 2% savings.

Pasar sing paling kompetitif: Lingkungan dhuwit seluler ing Afrika tansaya kompetitif. Kompetisi sing tambah iki tegese konsumen duwe opsi sing luwih akeh. Solusi Ceyron

Nggunakake kertu debit rendah: Kartu debit prabayar mung digunakake kanggo tumbas lan layanan titik- jaran (jarang). Para pemegang TOE, Nanging, duwe hak istimewa nampa dividen tahunan ing kertu CFL, sing bakal dadi motivasi gedhe kanggo wong nggunakake kertu kasebut.

Kurang kredit sing aman lan ora kenceng uga minangka pendapatan tetep lan stabil kanggo pelamar kredit: Ing Afrika, paling ora bisa ngundhakake kredit. CFL kepengin ngatasi masalah iki. Secara khusus, Tokoh CEY bisa dianggep minangka sumber pendapatan sing disebarake marang para pengusaha amarga layak kanggo kredit. Kejabi, aplikasi silihan nduweni defisit income sing stabil lan tetep.

Solusi CEYRON

Ora kanggo sebutno "standar" sing menehi proyek blockchain menehi integritas, keamanan, keamanan, anonim-aman lan transparan ing sistem desentralisasi berprestasi tinggi, CEYRON nawakake solusi apik kanggo masalah sing diidentifikasi ing ndhuwur:

CFL Credit Portfolio

Kanggo ngurangi volatility saka Token CEY, CFL ndhukung nilai kasebut liwat portofolio aset kredit aman. Sabanjure, panuku saka aset kredit portofolio banjur disimpen kanggo reinvestment maneh menyang portofolio aset kredit kanggo nyoba nambah dhasar dhasar sing dhuwure saben Token CEY.

Kanggo ngurangi volatility saka Token CEY, CFL ndhukung nilai kasebut liwat portofolio aset kredit aman. Sabanjure, panuku saka aset kredit portofolio banjur disimpen kanggo reinvestment maneh menyang portofolio aset kredit kanggo nyoba nambah dhasar dhasar sing dhuwure saben Token CEY.

Portofolio aset kredit, sing digawe kanthi nggunakake intelijen buatan lan mesin, bakal luwih aman saka bungkus jaminan kanggo nambah stabilitas lan pengembalian.

Kanggo mesthekake, Dana nduweni portofolio investasi alternatif apik banget karo jangkoan global kanthi tujuan ngasilake pulangan siji digit sing stabil kanthi volatilitas sing cendhak lan long-term banget. Diversifikasi ditindakake kanthi nggabungake dana alternatif sing dipilih karo strategi lan lokasi sing beda banget, dikelola dening manajer aset sing didegaké lan anjog ing gaya investasi utawa pasar tartamtu.

CEY Card Kartu

CEY: MasterCard fisik, virtual, lan debit kanthi aplikasi seluler sing bakal ngidini kanggo nggunakake 20 mata uang asing lan cryptocurrencies sing utama saka kertu tunggal.

CEY Card Kartu

CEY: MasterCard fisik, virtual, lan debit kanthi aplikasi seluler sing bakal ngidini kanggo nggunakake 20 mata uang asing lan cryptocurrencies sing utama saka kertu tunggal.

Nggunakake kertu iki, sampeyan bisa nglampahi, ngganti lan ngirim lan nampa dhuwit kanthi internasional kanthi anonimitas sing padha karo Bitcoin tanpa keterlibatan pihak katelu ing cara sing paling aman lan paling cepet.

CFL bisa nylametake pelanggan nganti 70% ing biaya kasebut:

CFL bisa nylametake pelanggan nganti 70% ing biaya kasebut:

Currency Transaction Fee: Currencies can be exchanged both at the point of sale through an app with 3% fee for CFL compared to 3.75% of industry average.

Cash Withdrawal Fee: CFL charges no fee for ATM withdrawals at all (the traditional standard fee for ATM withdrawals is 1.5%).

Money Transfer Fee: The CFL mobile application will contain additional functionality to transfer funds in any currency between merchants, as well as friends and family accounts, for free.

Bareng karo Kartu CEY, Situs Pengirim Ceyron Swasta memungkinkan Anda membeli dan menjual CEY dan cryptocurrencies lainnya.

Kejabi, Kertu CFL ngandhakake bakal duwe Partner kanggo ngetrapake biaya. Iki bakal ngijini integrasi saka aplikasi seluler kanggo nggampangake ngatur travel itineraries lan pranala menyang akeh travel partners kanggo e-panrimo Manajemen.

Tokoh Keamanan CFL

1. CFL intends to provide but does not guarantee, the token holders with an annual dividend, which must be approved by the Board of Directors and holders of voting shares.

2. CFL intends to invest eighty-five percent (85%) of the proceeds received by CFL from this Offering in the Fund, and the Fund, in turn, will invest in credit assets, thereby seeking to create a stable, growing cash flow yielding base for the CEY Token (Cash flow yields cannot be guaranteed, and may be impacted by both market and regulatory conditions).

3. CFL intends to use modest leverage to further enhance the returns from its credit portfolio to facilitate ongoing and continued reinvestment to grow the credit portfolio underpinning 15 the CEY Tokens (Enhanced returns cannot be guaranteed, and may be impacted by both market and regulatory conditions).

4. CFL will enhance its ability to establish its credit portfolio with leverage by providing its warehouse lender a credit surety bond.

5. CFL intends to maintain a cash, securities, and token reserve at all times to ensure liquidity for CEY Token holders (Liquidity of assets cannot be guaranteed, and may be impacted by both market and regulatory conditions).

6. CFL will enter into alliances with surety wrap providers that will be used to mitigate the risk of total capital loss. However, use of these financial instruments does not constitute a guarantee against any and all eventualities.

Aliansi Strategis Aliansi strategis

CFL minangka pimpinan lan pamimpin berpengalaman ing bidhang teknologi, keuangan, lan perbankan.

CFL minangka pimpinan lan pamimpin berpengalaman ing bidhang teknologi, keuangan, lan perbankan.

Coinfirm.io: CFL intends to enter into a service agreement with Coinfirm.io — a market leader in KYC/AML (Anti Money Laundering) checks for each token holder application.

Ambisafe is a blockchain technology pioneer and ICO offering company helping the world become more decentralized since 2010. Their work has been critical of projects such as Tether and Bitfinex. More recently Ambisafe is behind such ICO successes as Polybius, TaaS, and Chronobank. CFL and Ambisafe plan to jointly develop a wallet management tool, which CFL will use to facilitate token holders’ ability to manage their digital wallets.

Loyal Bank is a bank registered under the laws of Saint Vincent & The Grenadines and is the debit card provider having one of the most competitive fees across several fiat currencies in the industry. -> this partnership might allow CFL to maintain a low rate of 1% for transactions charge.

TLDR: Ceyron nggawe sawetara garis bisnis lan bakal nglaporake financial kanggo investor.

Firstly, they will have the Ceyron Funds, a secured portfolio built by a seasoned financial management team.

Secondly, Ceyron will also offer you the opportunity to spend, exchange and transfer cryptocurrencies and fiat currencies with their Ceyron Debit MasterCard and exchange site.

Finally, with so much market uncertainties, Ceyron is here to offer you one of the only private security tokens representing an equity portion of Ceyron with the intent to offer security, transparency and dividends — The CEY Token

- Tim

Ceyron Finance Ltd digawé dening tim saka mantan Bankers saka Bank USA sing biso dipercoyo.

Papan eksekutif

EB kasusun saka talenta sing dialami ing bidang perbankan, bisnis lan investasi finansial, sing minangka titik kuat kanggo tim ing implementasine gagasan proyek.

Siji bab sing nggawe aku kuwatir yaiku tim Dev. Wiwit biasane nalika ICO, para manajer proyek bakal nampilake para pengembang genius (bareng karo bakat ing lapangan layanan, kaya sing dituduhake ing ndhuwur). Nanging iki ICO aku mung bisa ndeleng Blockchain & Technology Solutions Head. Siji geguritan yaiku wong iki (wong Kepala IT) nduweni 10 taun pengalaman ing pembangunan tumpukan lengkap, solusi IT lan pengembangan blockchain.

Padha duwe akeh sumber daya kanggo aktivitas pemasaran, sing apik tumindake ing tahap iki cryptocurrency world amarga wong sing efek banget sensitif lan crowding bisa nyebabake akeh pump apik.

EB kasusun saka talenta sing dialami ing bidang perbankan, bisnis lan investasi finansial, sing minangka titik kuat kanggo tim ing implementasine gagasan proyek.

Siji bab sing nggawe aku kuwatir yaiku tim Dev. Wiwit biasane nalika ICO, para manajer proyek bakal nampilake para pengembang genius (bareng karo bakat ing lapangan layanan, kaya sing dituduhake ing ndhuwur). Nanging iki ICO aku mung bisa ndeleng Blockchain & Technology Solutions Head. Siji geguritan yaiku wong iki (wong Kepala IT) nduweni 10 taun pengalaman ing pembangunan tumpukan lengkap, solusi IT lan pengembangan blockchain.

Padha duwe akeh sumber daya kanggo aktivitas pemasaran, sing apik tumindake ing tahap iki cryptocurrency world amarga wong sing efek banget sensitif lan crowding bisa nyebabake akeh pump apik.

- Informasi akeh

Jeneng Token: Ceyron

Simbol Token: CEY

Contract Alamat: 0xebc71036a37451e87cc43af8ae7ac123aa750dcb

Desimal: 8

Price Token: $ 1.00 USD

Duit sing ditampa: BTC, ETH, LTC lan USD

Jumlah Token Dijual: 250.000.000

Pra-Sale: 2/16 / 18-3 / 15/18

Pra-Sale Diskon: 30%, 25%, 15%

Miwiti Token Sale: 3/16/18

Akhir Token Sale: Nalika Hard tutup wis tekan

Cap Soft: TBA

Hard Cap: TBA

Links

Links

Situs web: https://ceyron.io/

Whitepaper: https://ceyron.io/wp-content/uploads/2018/02/White-Paper-ICO-CEY-Token-UPDATED31012018.pdf

Saluran Telegram: https://t.me/joinchat/HlFUXhLIUYQL88_NtoM4sA

Tidak ada komentar:

Posting Komentar